The conventional belief from many people within the entrepreneurial ecosystem is that early-stage companies within the “flyover states” of the Midwest have little to no access to venture capital. People love to say that “there is a lack of venture capital in the Midwest.” This is a loaded statement that we think deserves unpacking because, ultimately, we disagree.

There are indeed fundamentally fewer venture capital firms with fewer assets under management located in the Midwest when compared to either coasts. However, that is not the context in which you usually hear this phrase. Instead, people like to cite the “lack of venture capital in the Midwest” as a rationale for why more startups are not coming out of the Midwest or why some feel it is difficult to raise capital. Let’s be clear, as long as there are startups, there will always be people who express frustration with fundraising.

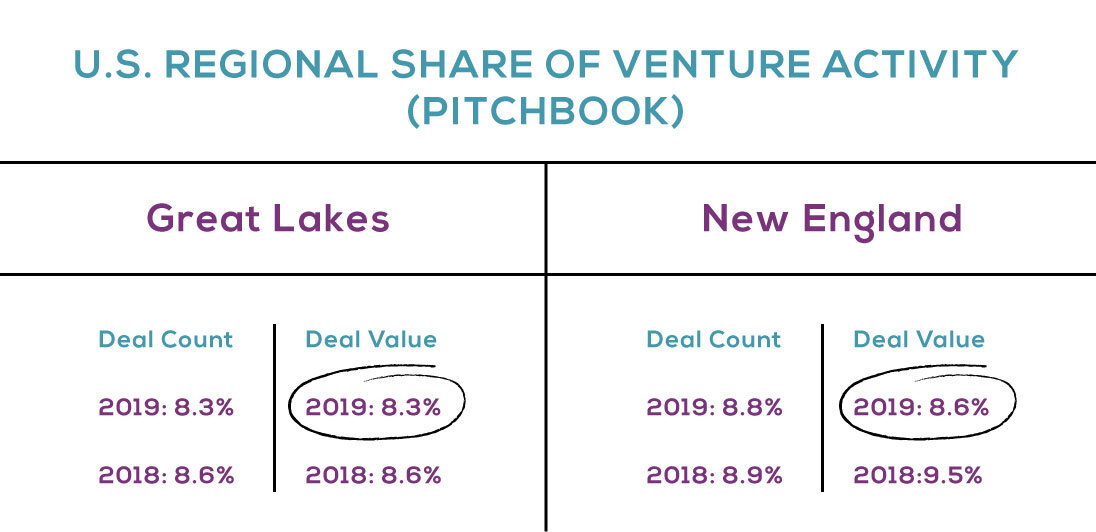

Taking an example from Pitchbook data, we see that the Midwest has roughly the same percentage of deals by number as New England: 8-9%. However, when you look at the percentage of Deal Value, New England has 2x the share of dollars invested as the Great Lakes.

How is it possible that New England is doing roughly the same number of deals but getting substantially more dollars? We can think of two explanations that likely work in tandem. A) New England is known for medical devices and pharma startups which inherently require more capital than your average startup. But more importantly, B) Startups in New England receive 2x the capital because they have more late-stage rounds (Series A+), while the Great Lakes has a lot of early-stage rounds (Angel/Seed).

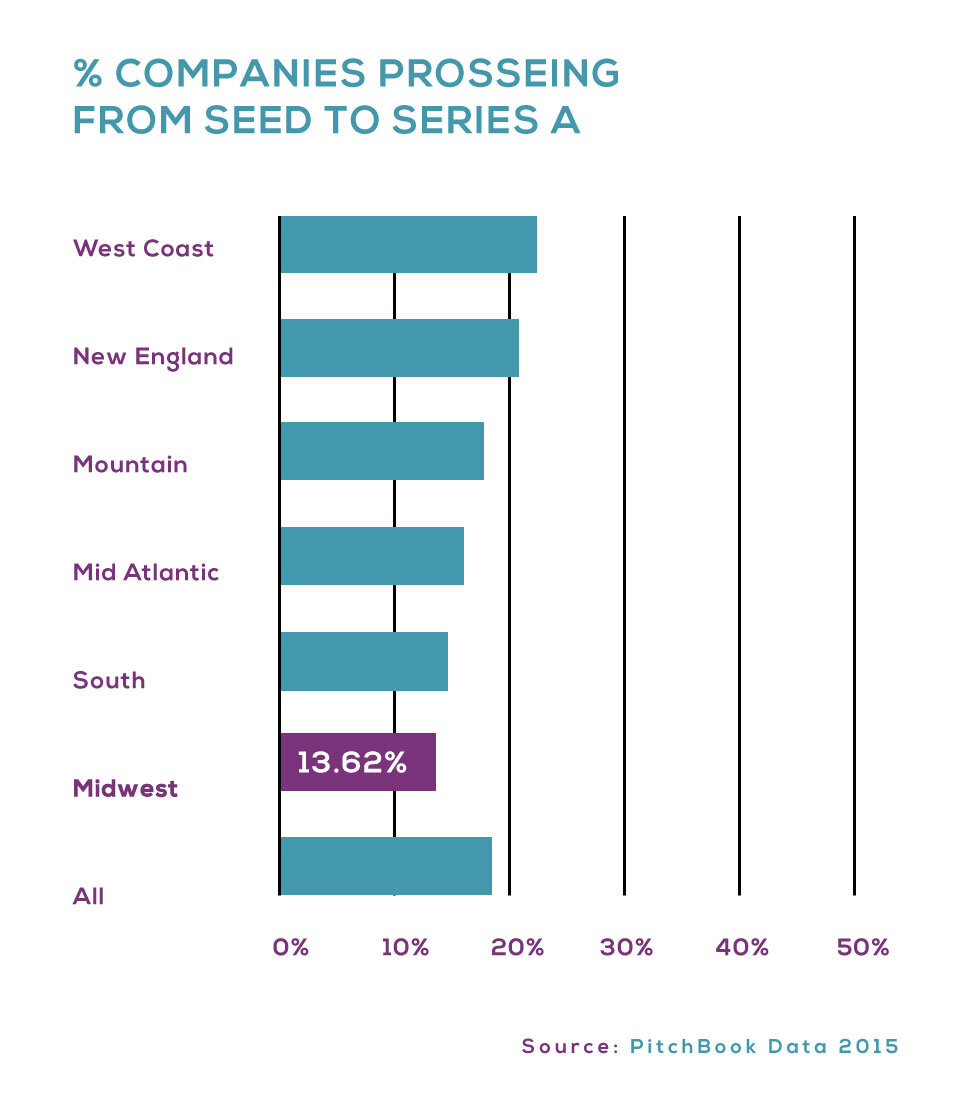

Seed to Series A Graduation Rates

Comparing the graduation rates of Seed Stage companies to Series A companies between 2015-2020, we see that the Midwest ranks last. Only 13.6% of Seed Stage startups in the Midwest will raise a Series A. This number is 20.6% in New England and 21.3% on the West Coast. Venture dollars are lacking in the Midwest because startups are not raising the bigger later stage rounds. Why is this?

Capital Follows Growth

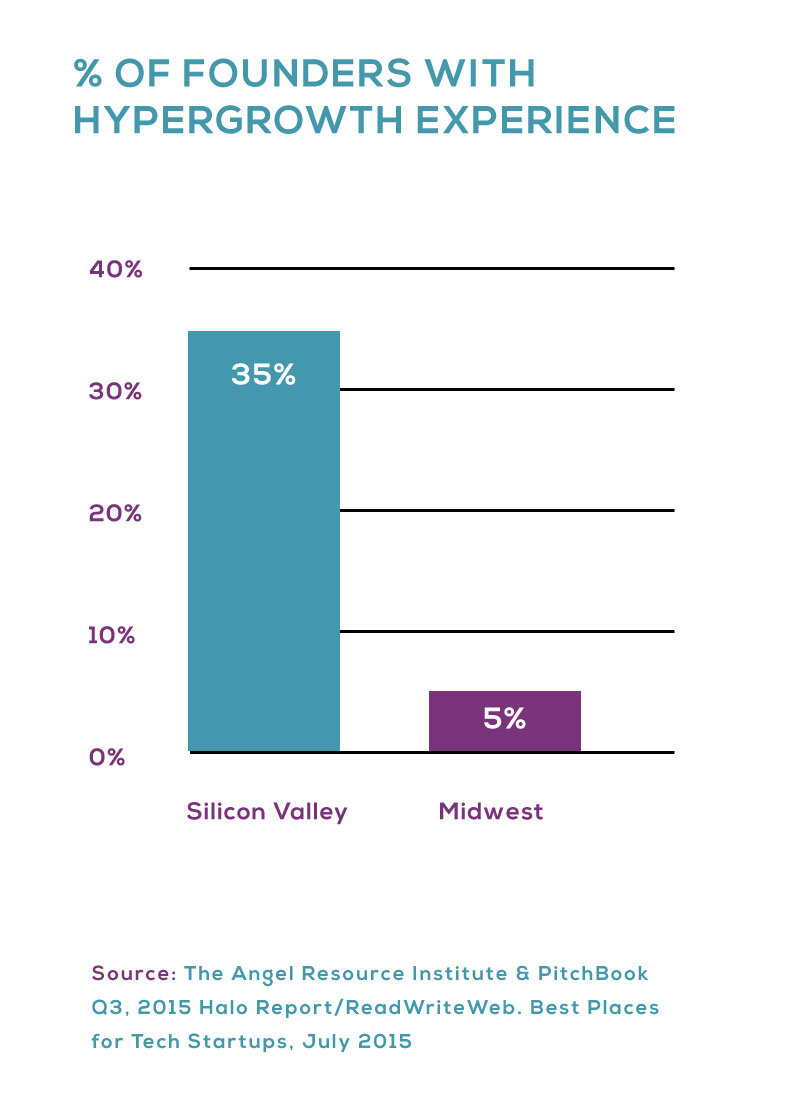

At Refinery, we like to say that “Capital Follows Growth.” In other words, if you have a hypergrowth startup, then you can be guaranteed that someone is going to fund it. In fact, hypergrowth startups are what attract coastal VCs to invest in the Midwest and other “flyover” regions. There are plenty of hypergrowth and amazing companies in the Midwest, but on average, Midwest startups fall short of their peers on the coasts when it comes to growth.

Perhaps the Midwest has not had enough large successful exits to create the virtuous cycle of employees gaining hypergrowth experience, exiting, and then founding/joining another startup to apply their hypergrowth knowledge. Perhaps Midwest startups are, on average, more focused on creating profitable businesses rather than fast-growing ones. Perhaps Midwest investors are pushing their portfolio companies to be more conservative when compared to their coastal VC counterparts.

Regardless, we believe that the average Midwest startup could benefit from focusing a bit more on growth. We fully recognize that this is an incredibly easy thing to say but an incredibly hard thing to do. However, it is important to be reminded that if you focus on having a great business, then the fundraising will come easy.

Where do we go from here?

We hope to extend our Seed to Series A graduation analysis by comparing Seed rounds led by Angels, Institutions, and Accelerators. Is there a meaningful difference based upon who participated in your Seed round regarding your ability to get to Series A?

We also welcome all comments and questions regarding this analysis. Do you agree with our above Seed to Series A graduation rates based upon your experience? Do you have any other ideas as to what causes the Midwest to lag?

Disclaimer: We recognize there may be flaws in our data and assumptions. We admit we have not proven anything but instead made hypotheses based upon data. We welcome any and all feedback and thoughts on where we might be wrong and how our thinking might be extended.