Welcome to the Great Lakes Hypergrowth Talent Roadmap, where we explore all the aspects of building high-growth teams.

Despite what you might think about Carta (and if you have used their product as a company builder in the past, I am sure you have some qualms), they do an excellent job with their research function. The great thing about trying to build the marketplace for startup equity is that you get to capture more data than really anybody else regarding startup and venture capital fundraising trends. Of course, with any of these exercises, some of this has to be taken with a pretty large grain of salt – how do they define “AI Startup” or “Series B” and how do they account for data that’s not on their platform. Regardless, they produce more interesting research than most folks who are trying and it does tend to feel directionally correct.

One area they have a particular advantage is in data surrounding startup hiring and compensation practices. They are able to identify this information because of the option pool data capture mechanism they have built – if you are a startup with an option pool, there is a very good chance the interface your employees are using is Carta. These aren’t surveys, this is actual data.

A lot of what has been produced so far tends to make sense and tracks with trends over the last couple of years. But I still think there are some pretty interesting things to learn from what they have produced. Let’s look at a couple of charts.

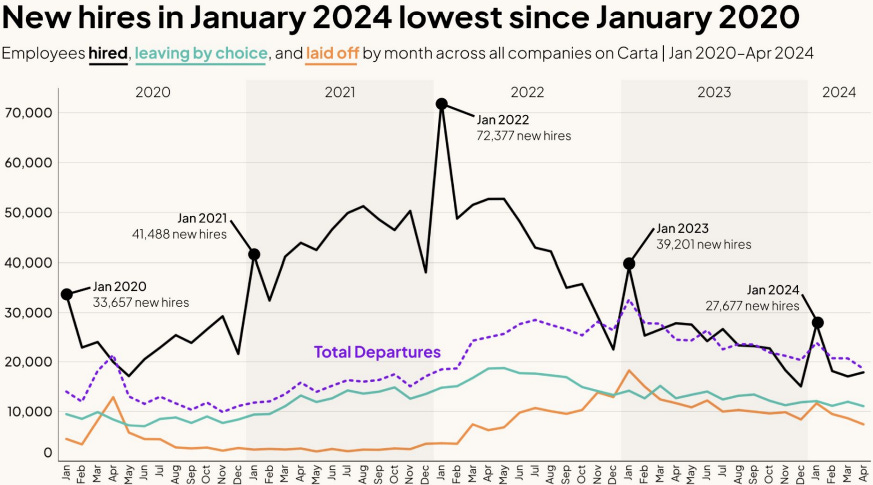

Despite valuations trending up, capital inflows trending up, and general investment sentiment improving, startups are still hiring less than they did at the start of 2023 and the start of 2022 and 2021. Companies are getting leaner. Fewer companies are being started, which creates fewer job opportunities. However, more companies were started in 2023 than 2024, so you might not necessarily expect this downward trend to continue. One other thing to track here is the amount of companies that are using AI to augment (and sometimes replace, although not exactly) their existing employee base. We have seen several instances in our portfolio where AI has been used very effectively to reduce the need for hiring. However, in some instances, it felt like AI was really delaying the need for hiring, which is something to monitor, but also might just be symptomatic of an evolving technology.

It’s also good to see that layoffs are down somewhat significantly. This seems relatively proportional to the decline in new jobs as well. It’s hard to lay off a lot of people if you aren’t hiring a lot of people in the first place.

Key takeaway: Technology is a deflationary factor. As new technologies arise, it follows that they will result in more organizational efficiency.

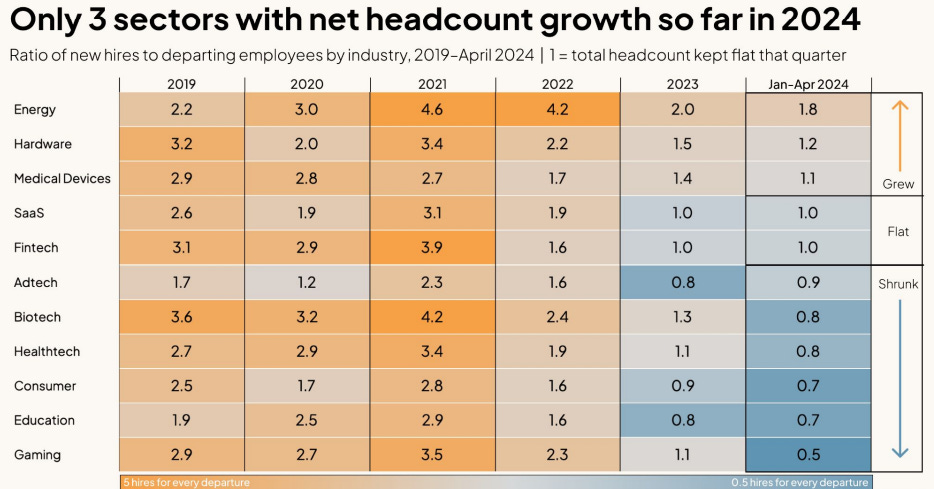

The only sectors that are still growing are Hardware, Medical Devices, and Energy. SaaS & Fintech are flat, while Gaming and Biotech have fallen off a cliff. Nobody is reaching 2019 levels even, which is further evidence that in 2023 and 2024 organizations were focused on right-sizing. Too much hiring occurred in 2020 – 2022 and companies spent the last two years figuring out what the right size for them moving forward would be.

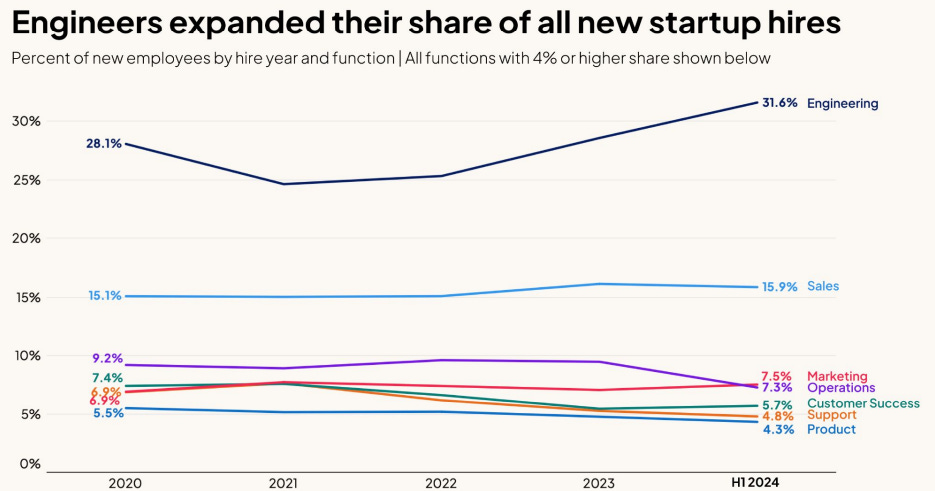

I thought software engineering was over? I thought coders were dead? I thought robots were writing everything? I am not ready to spike the football that engineers aren’t going anywhere, because I still think a lot of interesting things are going to happen to that profession. However, it is interesting in a year when co-pilots abound and there were a lot of “robots are writing all of the code” takes, engineering increased in importance.

This could be the result of a couple of factors, but two that are interesting to think about are:

1. As AI takes center stage, the products that get venture funded are the ones that are more complicated to build (and thus have a better moat), and thus, venture-backed companies become MORE reliant on devs, not less.

2. As easy money has flowed out of the system (for the most part), the only companies that are around are serious BUILDERS of product, and not just hype people really good at pitch decks and generating FOMO. As a result, the pretenders who were hiring for roles that didn’t matter, aren’t in the game anymore.

I think I believe in both of those things so far. I also think that it’s entirely possible that jobs hired are a lagging indicator for technological advances as well. In theory it takes companies a long time to catch on to important industry trends regarding people. But is that true for startups, who are incentivized to optimize people more than any other kind of company.

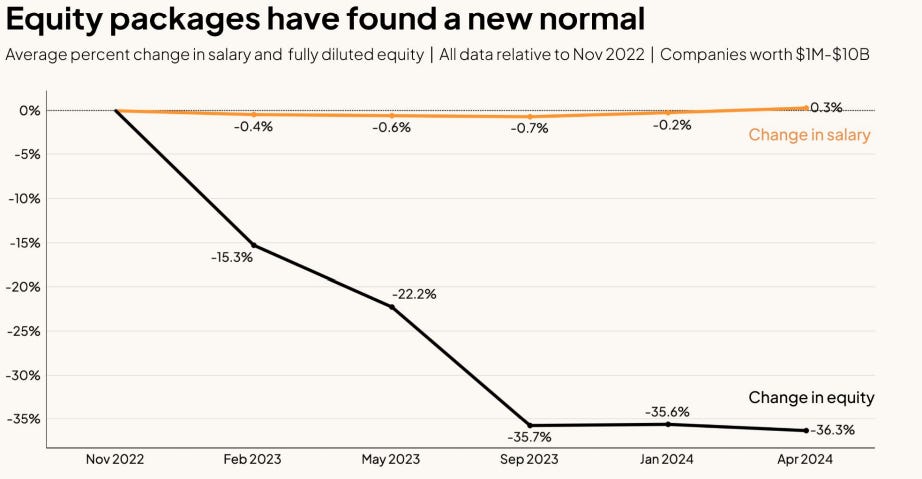

This one is simple. If you haven’t changed jobs in a while, or hired a bunch of people in a while, make sure that you have a really good feeling for what the market-clearing price is for equity options. It’s probably different from what you have remembered!

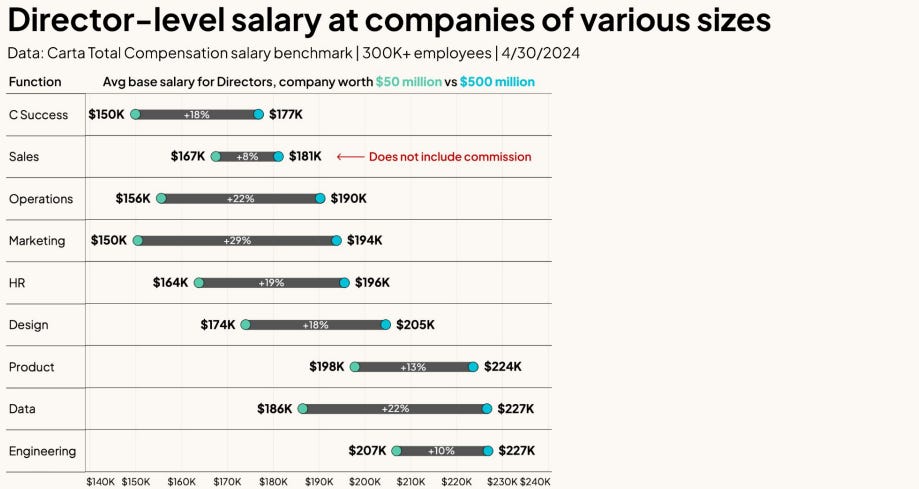

Just good darn data to know! Someone should track this every week and put it in a newsletter!

Stealth Job Opportunities

Reach out to Peter Schmidt, peter@refinery.com, if you would like to learn more about any of these positions.

1. Engineers, DevOps, and Product Leadership

Near Chicago, IL

This hypergrowth company is building an unique AI collaboration tool with good interesting traction. They are always hiring for Engineers and will need DevOps and Product Leadership positions in the next 6 months.

2. Go-to Market Talent

Near Pittsburgh, PA

This pharma-tech company is tackling hubs and solving PBM problems. They are seeking a candidate that knows how to sell into healthcare systems.

Hypergrowth Job Opportunities

From a curated list of startups and opportunities from our network.

Senior Software Engineer at Carefeed

Cincinnati, OH or Chicago, IL

Join the Payments team and build scalable, high-quality solutions using PHP/Laravel, Vue.js, TypeScript, and Tailwind. Ideal candidates have experience developing payments products and full-stack SaaS applications, with a strong focus on clean code, integrations, and mentoring junior developers.

SVP, Technology at Coterie Insurance

Remote – HQ Cincinnati, OH

Lead Engineering and Design teams to develop scalable, API-driven software that transforms commercial insurance into a seamless experience for small business owners, agents, and brokers.

Senior Manager, Partnerships at Matic

Columbus, OH

Drive the growth and optimization of client partnerships by leveraging data insights and collaborating with internal teams to deliver measurable outcomes to simplify insurance through embedded digital experiences. Ideal candidates excel in building relationships and executing strategies that achieve mutual revenue growth and long-term success.

Chief Operating Officer at RAIC Labs

Delafield, WI

Develop and execute strategic goals, oversee daily operations across departments, and drive continuous improvement in processes and productivity. You’ll provide financial oversight, foster team development, manage risk, and scale operations to support business growth.

Subscribe to receive the Hypergrowth Talent Roadmap every other Tuesday!