Welcome to the Great Lakes Hypergrowth Talent Roadmap, where we explore all the aspects of building high-growth teams.

Does A Rising Tide Lift All Boats in the Great Lakes?

Do people in Cupertino talk trash about San Jose? What about Mountain View or Los Altos – do they denigrate Palo Alto? Of course, I am sure they do in the way most neighborhoods / suburbs / communities will rag on adjacent communities. (For Parks & Recs fans, I am reminded of the Pawnee v. Eagleton beef). But at the end of the day, when one of these areas succeeds, the whole Bay Area succeeds as well.

So why does it feel like when Cincinnati’s economy succeeds, Cleveland is upset? When Columbus does well, does that mean that Detroit might suffer as a result? In the Great Lakes, it feels like a zero sum game when it comes to the success or failure of these lighthouse cities, like Cincinnati, Columbus, Cleveland, Indianapolis, Detroit, Pittsburgh, Chicago, etc. As if there isn’t enough to go around. If Chicago has a big hit, that means that more resources will go there, instead of towards Indianapolis or Minneapolis.

These are distinct cities, geographically, culturally, and economically. They all exist on their own merit, and most of them are growing and doing pretty well in 2025. When comparing Palo Alto to Cupertino, it’s actually a little harder to say that – are those places really distinct culturally, geographically and economically? No – at least to a layman. And so when one is able to attract really great talent, for instance, it’s not unreasonable to think that the other might benefit from that talent down the line as well.

What about something further out? Does Bellevue, Washington succeed when Seattle does well? Does Sacramento benefit from San Francisco’s success?

Could it also be true for the aforementioned Great Lakes cities?

The reality is that when one of these cities wins economically, it makes the broader region more desirable. It also helps recruit talent everywhere else. Most people on the coasts struggle to differentiate between Minneapolis and Indianapolis, and probably only know they are in different states because of some cultural touchstone, not because they could point it out on a map or because they have some deeper understanding of the differences between Indiana and Minnesota. Of course, I live near those two states, so I get how different they can be. However, when it comes to recruiting talent, does it really matter?

From a startup perspective, activity across these cities has risen in unison, buoyed by common tailwinds and a shared narrative of the “Rise of the Rest.” Booms and busts in venture funding have been regional, not just local, suggesting interlinked fortunes. The region as a whole has grown nearly 6x in venture funding since 2010, and each city has had a similar trajectory.

Historically, these cities were all largely interconnected by the Detroit Auto Industry. The term rust belt is literally in reference to the Auto and Steel industries that had tentacles spread out throughout the entire region. Tier 1-3 suppliers for automotive OEMs weren’t just in Michigan, but all over the region. It’s in this region’s DNA to have interconnected economies.

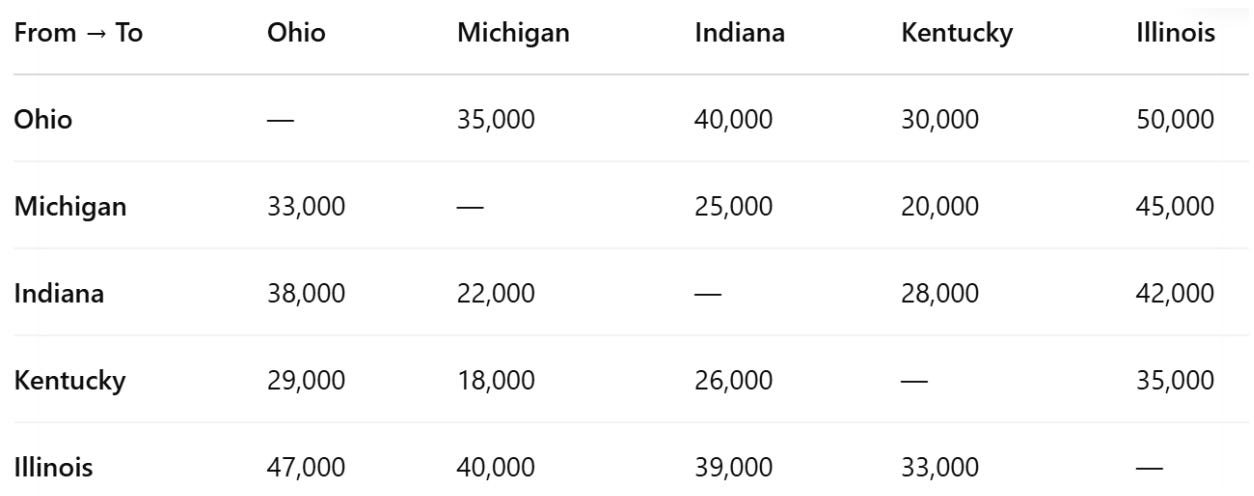

From a talent perspective, if you look at migration patterns in these states historically, there is a ton of overlap. Below are the estimated movements from 2010 – 2020.

The data tells that there is pretty neutral, but sizable net migration among these states. For most of these states, we know that there are different cities which drive the lion share of the population growth, so it’s okay to assume this is going on city to city, not just state to state. I would love to know what the migration patterns are specifically from city to city, but I couldn’t find that data.

How do these compare to other states in the region? See below for an overview of Ohio’s net migration patterns to more coastal cities (and Texas lol).

The volume is only really similar in places where there are massive populations. And even then, it only compares with Great Lakes states that are pretty small. Of course, this is just Ohio, but it’s relatively representative of the rest of the Great Lakes to the coasts as well.

People move, there is no doubt about that, but the cross pollination among Great Lakes states is undeniable.

On a grand scheme, these numbers are actually pretty small. When 12 million people live in Ohio, the movement of 50K here or there isn’t a HUGE deal. But these moves are representative of the broader point, which is that it is relatively (compared to the coasts) easy to move from one city to the next. And chances are, if you are in one of these cities, you have decent connectivity to the others.

In Cincinnati, everyone knows someone in Columbus, or Nashville, or Detroit. And don’t get me started on Chicago. It is the lighthouse city for the entire region. Almost every white collar professional lives there right out of school (a joke, but not a big one). When Chicago does well, it certainly feels like the other cities benefit from it.

So what does “DO WELL” even mean in this context? For me, as a venture investor based in Cincinnati, the main thing I care about is this: if one of these cities has a massive win, will that mean that the surrounding cities will also experience some benefit? The risk could be that when a big hit occurs in one of these cities, that the other cities suffer. It somewhat makes sense as a fear – if the city 2.5 hours away from me just made a bunch of money, does that mean my town lost out on that money?

Of course not!

There are several factors at play here.

First: Startups with great success typically spin out other great companies from their employee base (either literally from the company, or just in the sense that those employees leave and start something else). It’s often the case that these companies are started in the town where the prior company is based. My personal favorite example would be Redi.Health in Columbus, founded by a bunch of former CoverMyMeds (Columbus) and Beam Benefits (Columbus) employees (Refinery is an investor in Redi.Health).

But often, these employees won’t just stay in the same city, they might boomerang back home. There are a lot of former Groupon (Chicago) employees from the heyday that started companies in other cities outside of Chicago. Even Redi.Health has a co-founder that is based in Cincinnati. These things happen all of the time.

Second: Talent accessibility. It’s one thing to have founders from these companies turn around and found more companies, like the folks at High Alpha. And it’s another thing to have folks who weren’t founders, but just early employees (leadership lieutenants) turn around and start companies as described above. But the real litmus test of talent is if the folks who weren’t founders are willing to go and join those companies again in the same region that are starting up. In other words: can hypergrowth talent stay within hypergrowth companies?

There is some evidence that this is occurring. We see it in our portfolio companies almost across the board. However, we also preach this pretty heavily to our portfolio company CEOs, so that might not be a great sample to draw from. We also know that the post-remote world we live in saw a lot of these folks take remote jobs at companies on the coasts. While that’s not an ideal outcome, it is better than the prior average outcome, which was that those folks would look around for roles at similarly staged companies, couldn’t find any, and then just move to the coasts. Or they would go and work for a big corporation. We always joke that all the best startup tech product people eventually have a stint through Kroger when a startup they work for fails (or radically succeeds).

Third: Investors from all over the region, not just that city, and even those investors have investors from all over the place. This one is a pretty mixed bag. If you look at the top ten venture-backed exits for this space since 2010 (see below for list), practically all of them had regional venture capital on the cap table. However, it is rare that the lion share of the early backers were regional in nature. So while they had it in a technical sense, they might lack regional backing in a more spiritual definition of the concept.

1. Grubhub – 1 investor, based in Chicago

2. Exact Target – 1 investor, based in Indianapolis

3. Duo Security – 1 investor, based in Chicago, 1 investor based in Ann Arbor

4. Cleversafe – a ton of investors based in Chicago

5. TastyTrade – 1 investor, based in Chicago

6. Tegus – several investors based in Chicago

7. Root Insurance – 1 investor, based in Columbus

8. Sprout Social – 3 investors, based in Chicago

9. Paypal / Braintree – no investors in the region

10. Textura – no investors in the region

So while that third point is not a slam dunk, the first two feel pretty strong based on the experience at Refinery. We still likely have a long way to go to make the entirety of the Great Lakes feel like a more cohesive startup ecosystem (do not like that word), but we are in a decent place right now. As talent gets more fungible and more successes in these regions start piling up, I expect our shared prosperity to accelerate even further. So let’s get some points on the board.

Stealth Job Opportunities

Reach out to Peter Schmidt, peter@refinery.com, if you’re interested in learning more about these positions or have opportunities you’d like to share.

Sales Professional

Pittsburgh, PA

A fast-growing health tech company pioneering AI driven patient intake solutions is seeking a dynamic sales professional.

General Purpose Operations Executive

Chicago, IL

Seeking an experienced operations leader to drive growth at a CPG big data technology company.

Hypergrowth Job Opportunities

From a curated list of startups and opportunities from our network.

VP of Client Services at Axuall

Remote – HQ in Cleveland, OH

Design, implement and support large-scale deployments of technology for major healthcare clients.

Product Manager at Loop Returns

Remote – HQ in Columbus, OH

Salary Range: $112,800 – $169,200 a year

Seeking a strategic, user-focused candidates to lead roadmap development, stakeholder alignment, and discovery efforts that drive outcomes-based solutions.

Columbus, OH

Looking for a customer-obsessed candidates to scale their omni-channel B2B2C marketing engine, owning strategy, execution, and optimization to drive growth.

Portfolio Analyst at Signal Advisors

Detroit, MI

Conduct research, analyze portfolio performance, help develop investment strategies, and support the investment management team.

Subscribe to receive the Hypergrowth Talent Roadmap every other Tuesday!